HOUSTON, Nov. 05, 2025 (GLOBE NEWSWIRE) — Plains All American Pipeline, L.P. (Nasdaq: PAA) and Plains GP Holdings (Nasdaq: PAGP) today reported third-quarter 2025 results and provided the following highlights and recent developments:

Third-Quarter Results and Highlights

- Reported net income attributable to PAA of $441 million and net cash provided by operating activities of $817 million.

- Delivered solid Adjusted EBITDA attributable to PAA of $669 million.

- Exited the quarter with a 3.3x leverage ratio, toward the low end of our target range of 3.25x – 3.75x.

- In September, Plains successfully raised $1.25 billion in aggregate senior unsecured notes with proceeds allocated toward redeeming senior notes maturing in October 2025 and to partially fund recently announced acquisitions.

Recent Developments

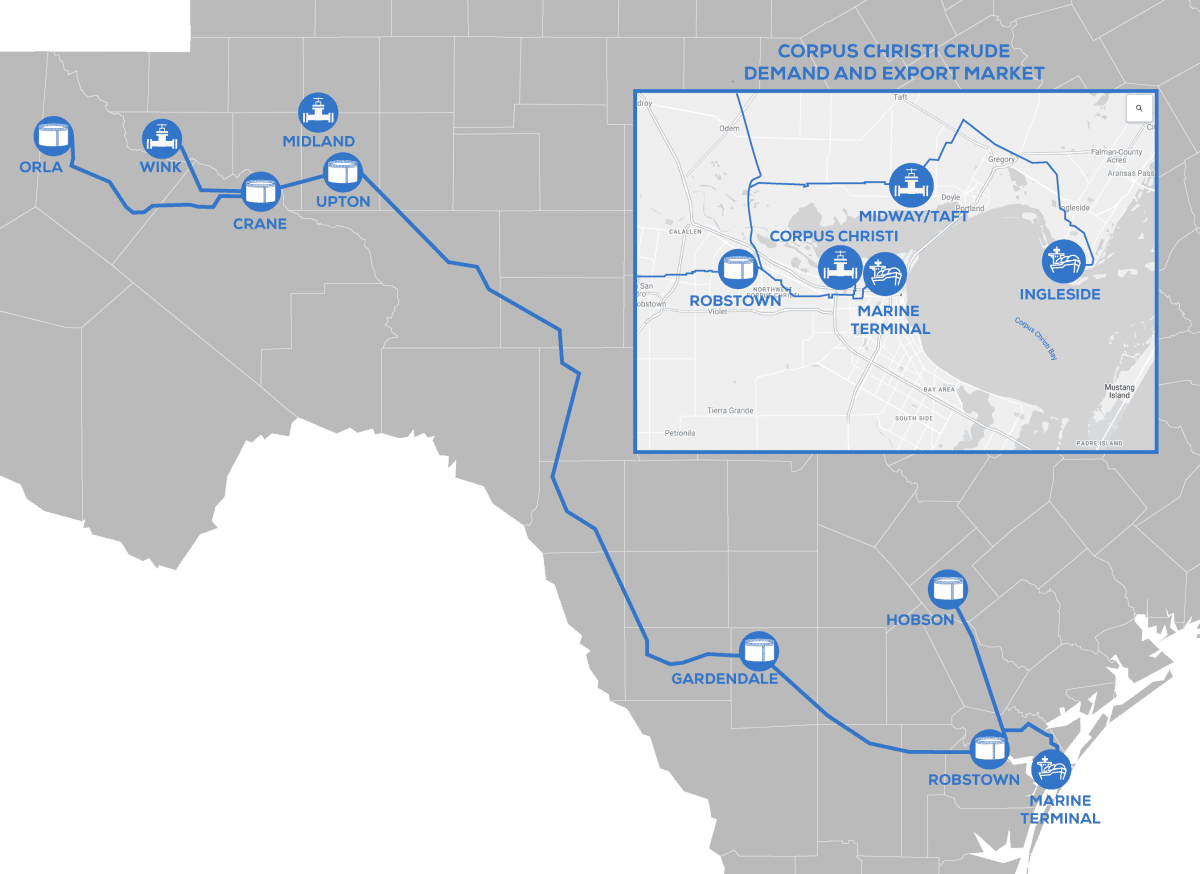

- On October 31, Plains completed the previously announced acquisition of a 55% equity interest in EPIC Crude Holdings, LP (“EPIC”), the entity that owns and operates the EPIC Crude Oil Pipeline (the “EPIC Pipeline”), from subsidiaries of Diamondback Energy, Inc. and Kinetik Holdings Inc.

- Effective November 1, Plains completed the acquisition of the remaining 45% operated equity interest in EPIC from a portfolio company of Ares Private Equity funds for a purchase price of approximately $1.33 billion, inclusive of approximately $500 million of debt. Additionally, Plains has agreed to a potential earnout payment of up to $157 million tied to certain expansions of the pipeline system by 2028. This transaction, along with the one described above, results in PAA owning a 100% equity interest in EPIC.

- The acquisition of the remaining 45% interest in EPIC allows us to accelerate and increase synergy capture on the full system, including meaningful 2026 cost savings. We expect solid mid-teens returns with a 2026 EBITDA multiple of approximately 10x, improving significantly over the next few years. Going forward, we intend to rename the system Cactus III, reflecting integration with our existing Cactus long-haul systems that we have operated for years.

- Expect leverage ratio toward the midpoint of the target range (~3.5x) post-announced acquisitions and upon closing our previously announced NGL divestiture (expected by the end of the first quarter 2026).

- Forecasting full-year 2025 Adjusted EBITDA attributable to Plains to be in the range of $2.84 to $2.89 billion, which includes approximately $40 million of contribution from our acquisition of EPIC.

“We have made significant progress in our journey of becoming the premier crude oil midstream provider. The pending divestiture of our NGL business, acquisition of EPIC, and streamlining efforts across the broader organization will provide tailwinds for the business despite near-term macro volatility. We remain committed to our capital allocation framework and returning cash to unitholders. Our approximately 9.5% distribution yield is well supported with distribution coverage and offers an attractive opportunity to participate in energy markets where we expect improving oil market fundamentals.”

– Willie Chiang, Chairman, CEO, and President

Financial Reporting Considerations for Pending Sale of Canadian NGL Business

On June 17, 2025, Plains entered into a definitive agreement to sell substantially all of its NGL business in Canada (the “Canadian NGL Business”) to Keyera Corp. This transaction is expected to close in the first quarter of 2026 and is subject to the satisfaction or waiver of customary closing conditions, including receipt of regulatory approvals.

While Plains will divest the Canadian NGL Business as part of the transaction, the company will retain substantially all NGL assets in the United States and will also retain all crude oil assets in Canada.

Plains has determined that the operations of the Canadian NGL Business meet the criteria for classification as held for sale and for discontinued operations reporting and has applied these changes retrospectively to all periods presented. Results throughout this release specify if they are presented from continuing operations (which exclude the results of the Canadian NGL Business) and/or discontinued operations.

Plains All American Pipeline

Summary Financial Information (unaudited) – More Click Here to view Summary Financials press release

(in millions, except per unit data)

About Plains:

PAA is a publicly traded master limited partnership that owns and operates midstream energy infrastructure and provides logistics services for crude oil and natural gas liquids (“NGL”). PAA owns an extensive network of pipeline gathering and transportation systems, in addition to terminalling, storage, processing, fractionation and other infrastructure assets serving key producing basins, transportation corridors and major market hubs and export outlets in the United States and Canada. On average, PAA handles over 9 million barrels per day of crude oil and NGL.

PAGP is a publicly traded entity that owns an indirect, non-economic controlling general partner interest in PAA and an indirect limited partner interest in PAA, one of the largest energy infrastructure and logistics companies in North America.

PAA and PAGP are headquartered in Houston, Texas. For more information, please visit www.plains.com.

Contacts:

Blake Fernandez

Vice President, Investor Relations

(866) 809-1291

Ross Hovde

Director, Investor Relations

(866) 809-1291