Transaction valuation represents approximately 1.9x 2024 rate base for the company’s Ohio natural gas business’s Local Distribution Company (Ohio LDC)

- Company will remain focused on delivering safe and reliable gas service to its West Central Ohio customers and provide a seamless transition

- Sale will continue Company’s strong track record of efficiently recycling capital by leveraging approximately $2.62 billion to support industry-leading $65 billion capital plan

- Transaction will also enable CenterPoint to reprioritize future capital investments across its more focused regulated electric and natural gas, multi-state utility footprint

- Company reiterates its recently increased non-GAAP EPS growth rate of 9% in 2025, and long-term EPS targets through 20351

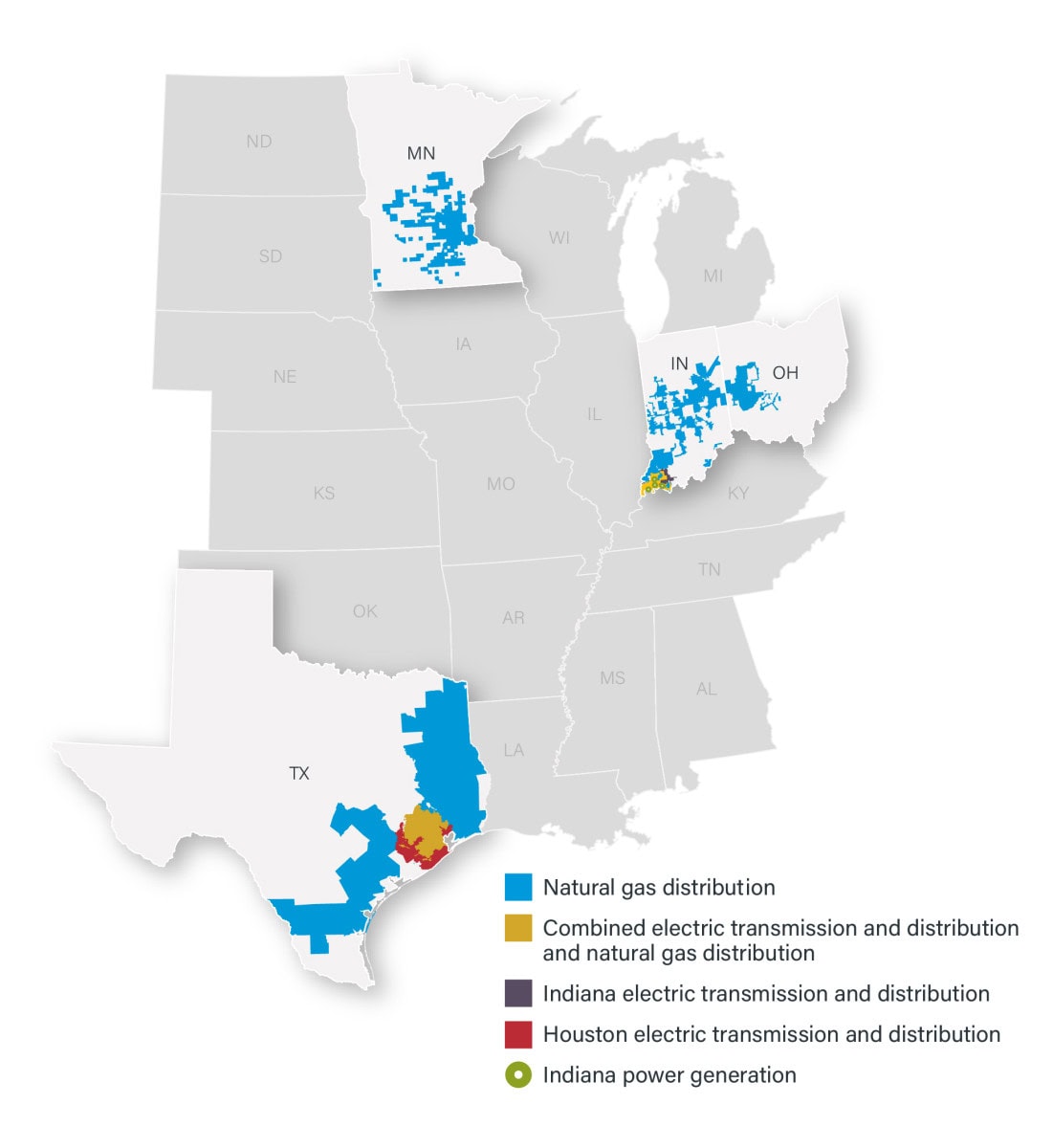

HOUSTON–(BUSINESS WIRE)–Oct. 21, 2025– CenterPoint Energy, Inc. (NYSE: CNP) (“CenterPoint” or the “Company”) today announced the sale of its Ohio natural gas Local Distribution Company (LDC) business, Vectren Energy Delivery of Ohio, LLC, to National Fuel Gas Company (NYSE: NFG), a diversified energy company headquartered in Western New York, for $2.62 billion. The assets include approximately 5,900 miles of transmission and distribution pipeline in Ohio serving approximately 335,000 metered customers.

The sales price of $2.62 billion represents an approximately 1.9x multiple of 2024 Ohio LDC rate base. The transaction is subject to customary closing conditions, including completion of Hart-Scott-Rodino review and completion of a notice filing and review with the Public Utilities Commission of Ohio.

CenterPoint expects the transaction to close in the fourth quarter of 2026. The Company expects to receive $1.42 billion in proceeds in 2026 and the remaining $1.20 billion in 2027 pursuant to a seller note to be entered into at closing.

“Our Ohio natural gas business is a strong and growing enterprise supported by a deeply committed local team focused on safety, excellence in execution, and delivering positive outcomes for customers. I would like to thank our Ohio natural gas employees and the other team members across CenterPoint who support this business for their continued dedication and service as we move through this process. Together with National Fuel, we will be focused on delivering a seamless transition for the approximately 335,000 customers in West Central Ohio, and we are confident that National Fuel will support the continued growth and success of the business for the benefit of customers, communities and employees,” said Jason Wells, Chair and Chief Executive Officer of CenterPoint Energy.

“As we shared recently, as part of our refreshed 10-year capital plan, this transaction will allow us to continue to optimize our portfolio of utility operations and efficiently recycle more than $2 billion back into our other electric and natural gas businesses which will help fuel our industry leading earnings growth over the next 10 years.”

“While we have executed several gas LDC transactions in the last few years to help continue to drive our growth, our natural gas business remains core to our overall company strategy of providing secure and reliable energy to millions of customers across Texas, Indiana and Minnesota where we have significant footprints and customer-centric investment plans,” added Wells.

Goldman Sachs & Co. LLC and Guggenheim Securities, LLC served as CenterPoint’s financial advisors. Gibson, Dunn & Crutcher LLP, Barnes & Thornburg LLP, Bricker Graydon LLP, and Whitt Sturtevant LLP served as CenterPoint’s legal advisors.

1 CenterPoint is unable to present a quantitative reconciliation of forward-looking non-GAAP diluted earnings per share without unreasonable effort because changes in the value of ZENS and related securities, future impairments, and other unusual items are not estimable and are difficult to predict due to various factors outside of management’s control.

About CenterPoint Energy, Inc.

As the only investor owned electric and gas utility based in Texas, CenterPoint Energy, Inc. (NYSE: CNP) is an energy delivery company with electric transmission and distribution, power generation and natural gas distribution operations that serve more than 7 million metered customers in Indiana, Minnesota, Ohio and Texas. As of June 30, 2025, the Company owned approximately $44 billion in assets. With approximately 8,300 employees, CenterPoint Energy and its predecessor companies have been in business for more than 150 years. For more information, visit CenterPointEnergy.com.

About National Fuel

National Fuel is a diversified energy company headquartered in Western New York that operates an integrated collection of natural gas assets across four business segments: Exploration & Production, Pipeline & Storage, Gathering, and Utility. Additional information about National Fuel is available at www.nationalfuel.com.

Use of Non-GAAP Measures

As included in this news release, CenterPoint provides guidance based on non-GAAP income and non-GAAP diluted earnings per share. Generally, a non-GAAP financial measure is a numerical measure of a company’s historical or future financial performance that excludes or includes amounts that are not normally excluded or included in the most directly comparable GAAP financial measure.

Management evaluates CenterPoint’s financial performance in part based on non-GAAP income and non-GAAP diluted earnings per share. Management believes that presenting these non-GAAP financial measures enhances an investor’s understanding of CenterPoint’s overall financial performance by providing them with an additional meaningful and relevant comparison of current and anticipated future results across periods.

Non-GAAP EPS guidance excludes:

- Earnings or losses from the change in value of CenterPoint’s 2.0% Zero-Premium Exchangeable Subordinated Notes due 2029 (“ZENS”) and related securities;

- Gains, losses and impacts, including related expenses, associated with mergers and divestitures, such as the divestiture of our Louisiana and Mississippi natural gas LDC businesses and our expected divestiture of our Ohio natural gas LDC business; and

- Impacts related to temporary emergency electric energy facilities once they are no longer part of our rate-regulated business.

Forward-Looking Statements

This news release may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical fact included in this news release are forward-looking statements made in good faith by us and are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include, but are not limited to, the timing of the closing of the Transaction, the timing and receipt of Seller Note proceeds and the Company’s intended use of the proceeds of the Transaction as well as statements about the Company’s capital plans and earnings growth. Each forward-looking statement contained in this news release speaks only as of the date of this news release.

View source version on Business Wire: https://www.businesswire.com/news/home/20251021642576/en/

Communications

Media.Relations@CenterPointEnergy.com

Source: CenterPoint Energy, Inc.