Capital spending targets Permian Basin output, technology efficiency and U.S. energy security

Chevron plans to invest approximately $10.5 billion in U.S. energy activities and projects in 2026, reinforcing its strategy to scale domestic oil and gas production while supporting industrial growth, employment and energy security across key producing regions.

The planned spending underscores Chevron’s continued focus on the Permian Basin, where the company has emerged as one of the largest producers in the United States, alongside investments in digitalization, emissions-reduction technologies and operational efficiency across its American portfolio.

Production growth anchors capital allocation

Chevron’s U.S. investment strategy is closely tied to its upstream performance. In 2024, the company increased U.S. production by nearly 20%, driven primarily by shale development, and now produces about 1 million barrels of oil-equivalent per day (BOE/d) in the Permian Basin alone.

The Permian Basin, spanning West Texas and southeastern New Mexico, is the largest oil-producing region in the country and remains the backbone of U.S. crude supply growth. According to energy consultancy Wood Mackenzie, nearly 70% of oil production from the Lower 48 states is expected to come from the Permian Basin before 2040, highlighting its long-term strategic importance.

Chevron’s sustained capital deployment reflects confidence in the basin’s multi-layered shale geology, which enables high-intensity development through horizontal drilling and hydraulic fracturing, delivering competitive breakeven costs compared with global peers.

Technology, data and efficiency gains

Beyond scale, Chevron is prioritizing operational efficiency through technology. The company holds a revenue interest in roughly one out of every five Permian Basin wells, providing access to extensive operational data across the region. Chevron is increasingly applying advanced analytics and artificial intelligence to that dataset to improve well design, execution and production performance.

Operational innovations such as simultaneous multi-well hydraulic fracturing (triple-frac techniques) and longer horizontal laterals have reduced development time and unit costs, allowing Chevron to maximize returns on capital even in a volatile commodity price environment.

In Colorado, where Chevron produces approximately 400,000 BOE/d, the company operates integrated control centers using digital systems to monitor assets around the clock, improving safety, reliability and uptime.

Emissions reductions and footprint optimization

Capital spending is also being directed toward emissions performance. Chevron has deployed next-generation tankless production facilities in Colorado that reduced greenhouse gas emissions by more than 90% in 2024 compared with legacy designs, while cutting surface footprint by over 95%.

These investments align with Chevron’s broader objective of lowering carbon intensity across its upstream operations while maintaining oil and gas as core contributors to U.S. energy supply.

Economic impact and job creation

Chevron’s domestic investment footprint extends beyond production volumes. Since 2022, the company has spent $44 billion with U.S. vendors and suppliers, supporting manufacturing, logistics and service companies across multiple states.

In the Permian Basin alone, Chevron-related activity supported approximately 630,000 jobs in Texas and 145,000 jobs in New Mexico in 2023. Nationwide, Chevron estimates its operations supported more than 850,000 U.S. jobs that year.

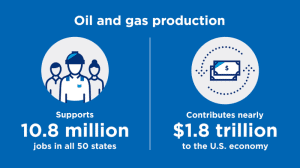

The broader oil and gas sector remains a critical economic driver. According to a 2021 study prepared for the American Petroleum Institute, oil and gas activity supports 10.8 million U.S. jobs and contributes $1.8 trillion annually to the U.S. economy.

Strategic positioning for U.S. energy security

Chevron’s planned $10.5 billion U.S. investment in 2026 reflects a long-term bet on domestic resource development at a time when energy security, industrial resilience and supply chain reliability remain top policy and economic priorities.

With a century-long presence in the Permian Basin, a growing production base and increasing use of data-driven technologies, Chevron is positioning its U.S. portfolio as a cornerstone of both shareholder returns and national energy supply heading into the next decade.