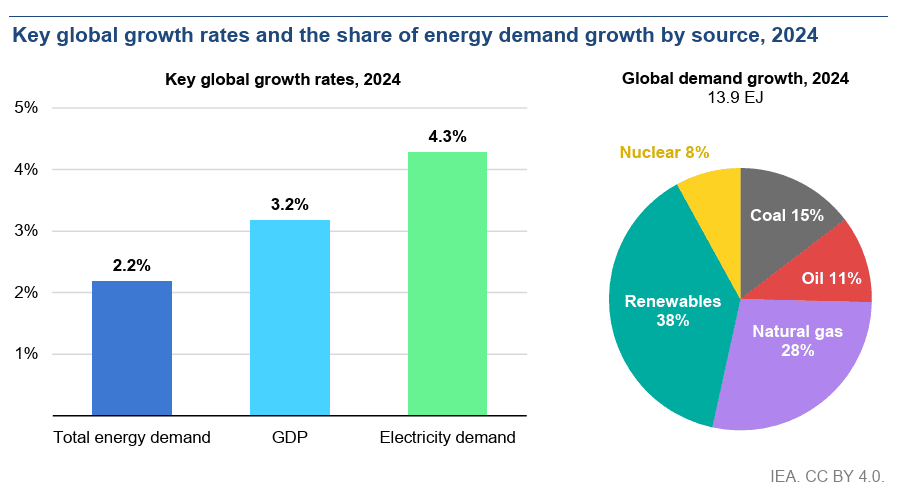

The International Energy Agency (IEA) has released its “Global Energy Review 2025″, offering a detailed snapshot of energy trends worldwide in 2024. The report reveals that global energy demand increased by 2.2%, a faster rate than the average of the last decade, driven by an unprecedented surge in electricity consumption, which grew by 4.3%. This spike was largely fueled by high cooling needs from extreme temperatures, greater industrial use, widespread electrification, and the rapid expansion of data centers and artificial intelligence systems.

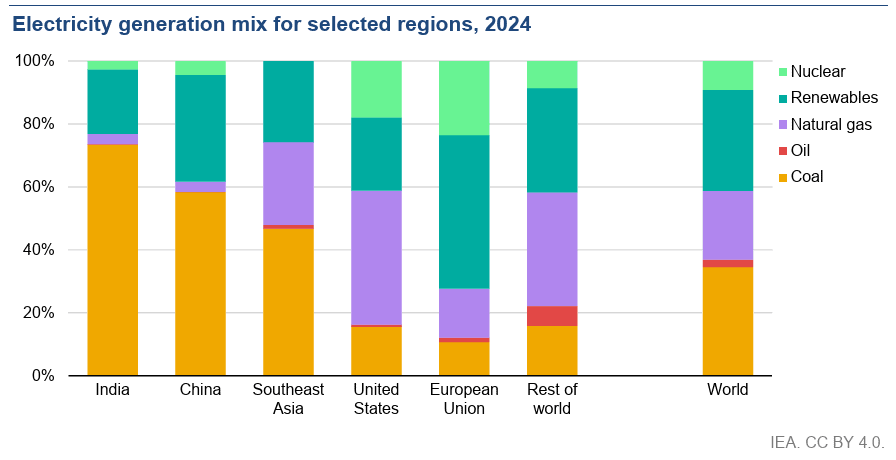

Electricity was the fastest-growing energy end-use in 2024, and nearly all of the increased demand was met by low-emissions sources. Renewables, especially solar PV, contributed the largest share of growth (38%), followed by natural gas (28%) and coal (15%). For the first time, renewables and nuclear together provided 40% of total global electricity generation. Notably, solar PV and wind accounted for nearly 95% of new renewable capacity, with China adding more renewable capacity than the rest of the world combined.

Regionally, emerging and developing economies accounted for over 80% of the global energy demand growth. China remained the largest contributor, although its demand growth slowed significantly. India ranked second in absolute demand increase, outpacing all advanced economies combined. Meanwhile, energy demand in advanced economies reversed recent declines, with the United States and the European Union both returning to growth.

Despite increased clean energy deployment, global energy-related CO₂ emissions reached a new high of 37.8 gigatonnes, growing by 0.8% year-on-year. The rise was largely attributed to extreme heat, which increased energy use for cooling. Still, the IEA emphasized that clean technologies installed since 2019 – like solar, wind, nuclear, EVs, and heat pumps – now avoid 2.6 billion tonnes of CO₂ emissions annually. Without extreme weather, emissions would have risen just half as much in 2024.

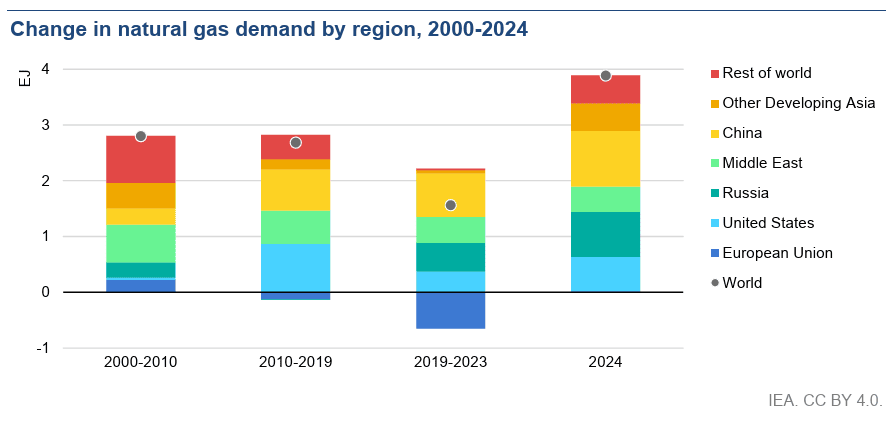

Oil demand growth slowed sharply to 0.8% – falling below 30% of global energy supply for the first time, mainly due to rising electric vehicle adoption and weaker demand in road transport across China and advanced economies. By contrast, natural gas demand rose 2.7%, the strongest among fossil fuels, with China, India, and the United States leading the gains. Global coal demand grew by 1%, driven by power generation needs in Asia, though consumption continued to fall in advanced economies.

The IEA also warned that energy intensity improvements, a key metric for efficiency, slowed to just 1% in 2024, the weakest rate in years. The report links this stagnation to manufacturing-heavy growth in emerging economies, poor hydropower output in recent years, and persistent reliance on fossil fuels. Although global economic growth outpaced emissions growth, suggesting continued decoupling, the pace remains insufficient to meet long-term climate targets.